Factors Influencing Silver Prices in Australia

Silver prices in Australia are a topic of great interest for investors and analysts. Understanding the factors that influence these prices is crucial. The silver market is complex, with many variables at play. Global economic conditions, local demand, and currency fluctuations all have an impact.

The Australian dollar (AUD) plays a significant role in determining silver prices. Exchange rates can cause prices to rise or fall. Investors often view silver as a safe-haven asset. During times of economic uncertainty, demand for silver can increase.

This article explores the key factors affecting silver prices in Australia. It provides insights into current trends and future predictions.

Understanding Silver Price AUD: An Overview

Silver price AUD refers to the valuation of silver in terms of the Australian dollar. It’s essential for both investors and traders to grasp this concept. The silver price in Australia is influenced by various factors, both globally and domestically. Silver serves dual purposes as both an industrial and a precious metal. This dual role leads to diverse influences on pricing.

Industrial demand, particularly in electronics and solar panels, affects silver prices significantly. Meanwhile, its status as a precious metal ties it to investor sentiment and economic conditions.

To better understand silver price AUD, consider the following aspects:

- Currency Exchange Rates: Impact prices by altering the relative value of silver when sold.

- Economic Indicators: Include interest rates, inflation, and GDP growth.

- Market Trends: Observe historical pricing patterns and speculative activities.

Additionally, geopolitical events and policy changes can lead to sudden shifts. Central bank actions and monetary policy decisions are particularly influential. Therefore, those investing in silver should stay informed about these dynamic factors. Understanding these fundamentals is key to navigating the silver market effectively in Australia.

Key Global Factors Affecting Silver Price Australia

Global dynamics play a crucial role in shaping silver prices in Australia. The interconnected nature of international trade means that local prices cannot be viewed in isolation.

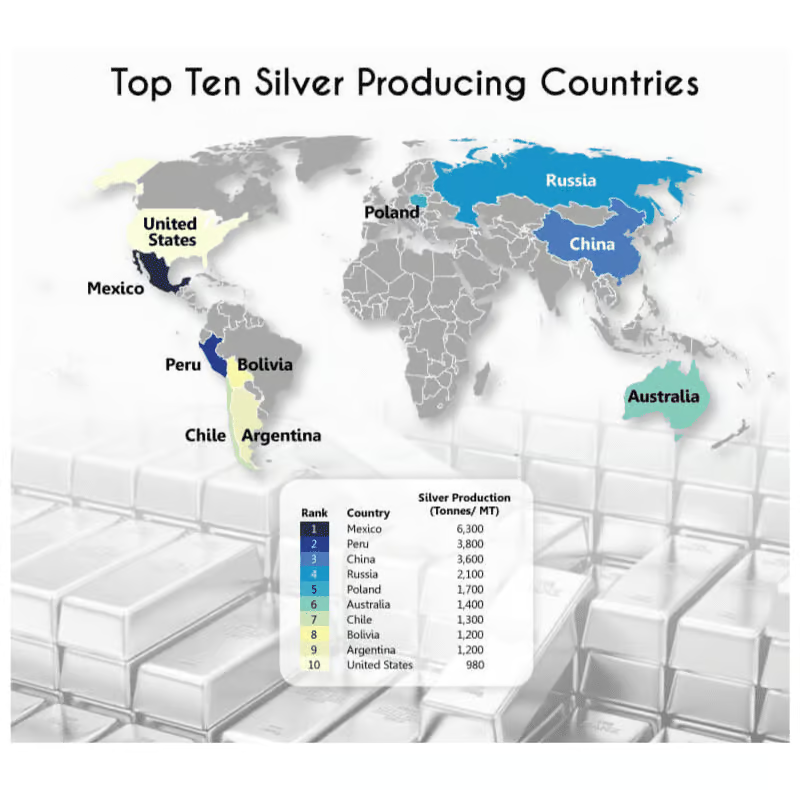

One of the prominent global factors is the balance between supply and demand. Major silver-producing countries, such as Mexico and Peru, heavily influence global supply levels. Any disruption or change in these countries can ripple through to affect Australian prices.

Demand for silver is also driven by worldwide industrial needs. Silver’s use in electronics and renewable energy contributes significantly to its global demand. These industries continually evolve, thus impacting silver’s market dynamics.

Geopolitical tensions and international economic policies also affect the market. Political unrest or instability can lead investors to seek safety in precious metals. Trade agreements or tariffs might alter the flow and pricing of silver, further complicating the market landscape.

Key global factors include:

- Supply Levels: Output from leading mining countries.

- Industrial Demand: Growth in technology and energy sectors.

- Geopolitical Events: Political or economic uncertainties.

- Trade and Tariffs: International agreements impacting exports/imports.

- Economic Policies: Actions of central banks worldwide.

In addition to these, currency fluctuations and central bank actions significantly influence silver pricing. Understanding these global factors offers valuable insights into predicting and reacting to changes in the silver market. Awareness and strategic planning are always essential for making informed investment decisions.

The Role of the Australian Dollar in Silver Price Movements

The Australian dollar’s value significantly influences silver prices in the country. As a traded commodity, silver’s price in AUD fluctuates with currency strength.

When the AUD strengthens, silver becomes cheaper domestically. This effect occurs because less local currency is needed to purchase the same amount of silver priced in US dollars. Conversely, when the AUD weakens, silver prices tend to rise in Australia.

Foreign exchange markets are dynamic and impacted by various elements. Interest rates set by the Reserve Bank of Australia, economic growth, and investor sentiment all sway the AUD. These elements can create ripple effects in silver pricing.

Investors must closely monitor exchange rates to grasp potential price changes. Short term silver trading strategies often center around adjusting to currency shifts to avoid losing money.

Key factors relating to AUD include:

- Exchange Rates: Impact on silver’s local valuation.

- Interest Rates: Influence by central bank policies.

- Economic Indicators: Growth, inflation, and sentiment impacting AUD.

Australian dollar movements are critical for those trading or investing in silver. These fluctuations require careful analysis and understanding, providing opportunities and risks in the silver market.

Local Supply and Demand Dynamics in Australia

Silver’s local supply and demand dynamics significantly affect its price in Australia. Australia is home to numerous silver mines contributing to the global market. The country’s mining output can either stabilize or shift silver prices based on production levels.

Demand for silver in Australia stems from both industrial applications and consumer markets. Silver is crucial in electronics, solar panels, and jewelry, driving consistent demand. Changes in these sectors directly influence price movements.

Market forces, such as increasing demand or reduced mining output, can create supply constraints. These constraints often lead to price surges, affecting investors and industry players alike. Local economic activities and consumer preferences also play roles. Diverse applications of silver maintain its market importance, highlighting how local dynamics intricately weave into global patterns.

Factors influencing local supply and demand include:

- Mining Output: Changes affecting silver availability.

- Industrial Usage: Demand in technology and energy sectors.

- Consumer Preferences: Trends in silver jewelry and ware.

Understanding these local dynamics is vital for stakeholders in Australia. They help anticipate shifts and make informed decisions in the silver market.

Industrial and Technological Demand for Silver

Silver is indispensable in various industrial applications due to its unique properties. Its excellent conductivity and antimicrobial characteristics make it ideal for technology and healthcare industries. As technology advances, the demand for silver continues to rise.

One major area where silver demand surges is in renewable energy. Solar panels, in particular, require significant amounts of silver due to its efficiency in electricity conduction. As the world moves towards sustainable energy, silver’s role becomes increasingly prominent.

Additionally, the electronics industry relies heavily on silver for manufacturing. Its use in smartphones, tablets, and other devices highlights its importance. This ongoing technological integration ensures a steady demand, impacting silver prices.

Key areas driving technological demand:

- Renewable Energy: Growth in solar panel production.

- Healthcare: Usage in medical tools for its antimicrobial properties.

- Electronics: Essential for modern devices and tech equipment.

These industrial demands underline the significance of silver in driving modern innovation and production. As these sectors expand, silver’s importance and price volatility will likely grow correspondingly.

Silver as an Investment: Safe-Haven and Portfolio Diversification

Silver has a long-standing reputation as a safe-haven asset. During times of economic uncertainty, investors often turn to silver to protect their portfolios. Its intrinsic value and tangible nature make it an attractive option for preserving wealth.

Moreover, silver plays a crucial role in portfolio diversification. Unlike stocks or bonds, silver prices can move independently, providing balance and reducing overall investment risk. This diversification is often considered essential, especially when facing volatile markets or unexpected financial crises.

Investors can gain exposure to silver through various methods. These include purchasing physical silver, investing in silver ETFs, or trading silver futures. Each option offers different levels of risk and reward, catering to different investor preferences.

Key ways to invest in silver:

- Physical Silver: Coins and bars for direct ownership.

- Silver ETFs: Easy market exposure without physical storage.

- Silver Futures: Speculative trading for potential high returns.

Incorporating silver into an investment portfolio not only mitigates risks but also exploits its potential for appreciation. As a hedge against inflation and currency fluctuations, silver remains a strategic asset in financial planning.

The Impact of Government Policy and Regulation

Government policies significantly influence silver prices in Australia. Regulations on mining operations can affect production levels. Stricter environmental policies may lead to increased costs for mining companies, ultimately impacting the supply side of the market.

Trade policies and tariffs also play a crucial role in silver pricing. Changes in import and export duties can alter the cost of silver entering or leaving Australia, affecting local prices. Such policies can either boost or hinder the competitiveness of Australian silver in global markets.

Moreover, taxation policies on precious metals investment can impact investor sentiment. Favorable tax rates can attract more investors to silver, increasing demand and potentially driving up prices.

Key government impacts on silver:

- Mining Regulations: Affect production costs and supply.

- Trade Policies: Influence import/export dynamics.

- Taxation: Alters investor demand and market activity.

Historical Trends and Volatility in Silver Price AUD

Silver prices have been known for their volatility. Over the years, prices have experienced significant swings due to various influences. Both global events and local economic conditions contribute to these fluctuations.

Several historical events have impacted silver prices. Economic crises, such as the global financial crisis of 2008, led to increased demand for safe-haven assets like silver. Similarly, during periods of geopolitical tension, silver prices have often surged.

Examining past trends provides insights into potential future movements. However, silver’s volatile nature requires careful analysis and consideration by investors.

Key factors influencing historical volatility:

- Economic Crises: Increased demand for safe-haven assets.

- Geopolitical Tensions: Price surges during conflicts.

- Market Corrections: Sudden shifts due to investor behavior.

Future Outlook: Predictions and Emerging Trends

The future of silver prices in Australia is poised to be shaped by multiple emerging trends. As the global economy recovers, demand for industrial metals, including silver, is expected to rise. This recovery could drive price increases, especially with silver’s growing role in technologies.

Technological advancements are likely to keep influencing demand. Renewable energy technologies, such as solar panels, are incorporating more silver, while emerging markets in electric vehicles may further drive demand. These factors could potentially lead to higher long-term prices.

Experts also foresee changes due to environmental and policy shifts. Sustainable mining practices are gaining traction, potentially affecting supply dynamics. Moreover, the development of new financial products and investment vehicles could increase silver’s appeal to a broader range of investors.

Emerging trends impacting future silver prices include:

- Renewable Energy: Increased use in solar technology.

- Electric Vehicles: Growing demand for components.

- Sustainable Practices: Influencing mining supply and practices.

Conclusion: Navigating the Silver Market in Australia

Navigating the silver market in Australia requires a keen understanding of both global and local factors. By analyzing economic indicators, currency movements, and market trends, investors can better anticipate price shifts. Silver’s dual role as a precious and industrial metal adds complexity but also opportunities for diverse strategies.

Investors should remain vigilant about geopolitical and technological changes impacting demand. Keeping informed about environmental policies and global supply chain dynamics is crucial. By doing so, those interested in silver investments can make more informed decisions. With careful analysis and strategic planning, investors can harness silver’s potential in their portfolios.