Understanding the Value of Gold Sovereigns

Gold sovereigns have fascinated collectors and investors for centuries. These coins are not just pieces of gold; they are pieces of history. First minted in 1489, gold sovereigns have a rich legacy. They were reintroduced in 1817 and continue to be produced today.

Their appeal lies in their gold content and historical significance. Each coin tells a story of the era it was minted in. Understanding the value of gold sovereigns requires knowledge of several factors. These include gold market prices, rarity, and condition.

The face value of a gold sovereign is one British pound. However, its market value is much higher due to its gold content. Australian gold sovereigns, minted between 1855 and 1931, are particularly sought after. Their value can vary greatly based on mint year and condition.

Investors and collectors alike are drawn to gold sovereigns for their stability and potential appreciation. They are a tangible asset in uncertain economic times. This article will explore the factors that influence the value of gold sovereigns. It will provide insights for both seasoned collectors and new investors.

What Is a Gold Sovereign? History and Origins

A gold sovereign is a British gold coin with a remarkable history. First minted in 1489, it was commissioned by King Henry VII. This made the sovereign one of the oldest gold coins still in production today. The sovereign underwent changes before re-emerging in the modern era. It was reintroduced in 1817, featuring the iconic design of St. George slaying the dragon. This design was created by the renowned engraver Benedetto Pistrucci.

Gold sovereigns were not only produced in the United Kingdom. They were also minted across the British Empire, including in Australia, India, and Canada. This widespread minting added to their global appeal and historical significance. Here’s a brief overview of its historical journey:

- 1489: First issued under King Henry VII

- 1817: Reintroduced with the St. George and Dragon design

- 1855-1931: Minted in Australia during the gold rush

- Present: Continues to be minted, with enduring popularity

The composition of these coins has remained consistent. Each gold sovereign contains 22-carat gold, weighing 7.98 grams, with a gold content of 7.32 grams.

While the sovereigns began as currency, today they are collectors’ items. Their value now far exceeds their original face value. This transformation underscores their evolution from mere currency to valuable collectible and investment pieces

Gold sovereigns carry an intrinsic historical and cultural significance. The stories and craftsmanship behind these coins add to their allure. This allure captivates collectors, investors, and enthusiasts around the globe, ensuring the sovereign’s enduring legacy.

Anatomy of a Gold Sovereign: Design, Weight, and Gold Content

The gold sovereign’s design is a symbol of elegance and artistry. Its obverse typically features the reigning monarch’s portrait. Meanwhile, the reverse showcases the renowned St. George and the Dragon design, a testament to enduring artistic excellence.

The coin’s specifications contribute to its historic appeal. Each gold sovereign is crafted from 22-carat gold, a standard ensuring a high level of purity. With a total weight of 7.98 grams, it contains 7.32 grams of pure gold, underscoring its substantial gold content.

Collectors and investors appreciate the sovereign for these consistent attributes. The coin is known for it’s reliable composition. This makes it both a tangible piece of history and a potential safeguard of wealth.

Here are the key features of a gold sovereign:

- Design: Monarch’s portrait and St. George with Dragon

- Gold content: 22-carat gold with 7.32 grams of pure gold

- Total weight: 7.98 grams

Beyond its intrinsic gold value, the sovereign’s artistry adds to its desirability. Each coin represents superb craftsmanship, an aspect that truly resonates with collectors worldwide. The intricate details of the coin are a testament to the skill of the engravers.

Moreover, despite its modest size, the sovereign carries immense historical value. This small coin serves as a tangible link to the past. Its consistent design and weight have helped establish the gold sovereign as an enduring icon in the numismatic world.

The Face Value vs. Market Value of Gold Sovereigns

Gold sovereigns hold historical significance beyond their face value. Though each coin has a nominal value of one British pound, their true worth comes from other factors.

The market value of a gold sovereign is primarily driven by its gold content. This value fluctuates with global gold prices. Thus, the coin often trades much higher than its face value, reflecting its bullion worth.

Collector demand further elevates the market price. Rare and historically significant sovereigns can command substantial premiums. Their desirability increases the market value well beyond simple gold content calculations.

Consider these factors affecting gold sovereign value:

- Gold market price: Primary influence on market value

- Rarity and demand: Historical significance and scarcity

- Condition: High grades can boost value

Understanding these distinctions is key for investors and collectors. The gold sovereign embodies an intriguing blend of monetary history and investment potential. With market prices consistently outpacing face value, the sovereign remains a treasured asset for many.

Key Factors That Determine Gold Sovereign Value

Understanding the value of gold sovereigns requires recognizing various influential factors. The gold sovereign’s worth goes beyond just its metal content.

One primary determinant is the market price of gold. This factor dictates the baseline value of the sovereign, aligning with global gold trends.

Rarity plays a pivotal role too. Limited mintages and specific years of issue can significantly boost a sovereign’s value. Collectors often seek these unique pieces.

The coin’s condition is another essential aspect. Well-preserved gold sovereigns fetch higher prices. Thus, grading becomes crucial in evaluating the coin’s condition.

Historical significance adds to a sovereign’s appeal. Coins from notable eras or events can attract higher demand and price.

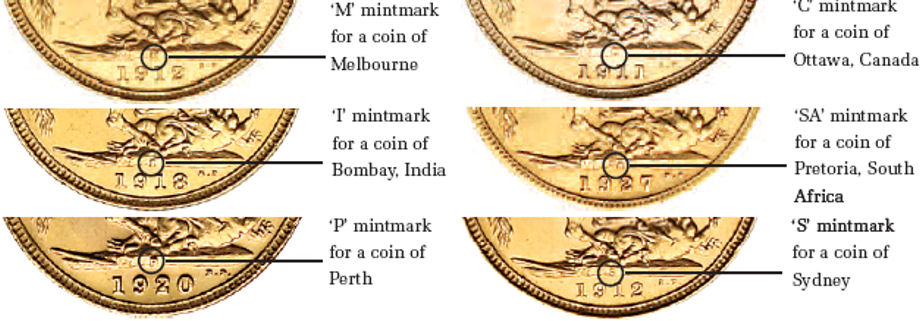

Specific mint marks also influence value. Certain mints, like Sydney or Perth, may command a premium due to collectibility.

Here are some key factors affecting gold sovereign value:

- Gold market price: Foundation of coin’s bullion value

- Rarity: Scarce mint years boost desirability

- Condition: Graded coins maintain or increase worth

- Historical significance: Adds layers of value

- Mint marks: Particular mints attract collectors

By understanding these factors, investors and collectors can make informed decisions about acquiring gold sovereigns. This comprehensive approach ensures a deeper appreciation for the coins’ historical and monetary significance. With their diverse influences, gold sovereigns continue to be valuable assets for collectors and investors alike.

Choosing the right sovereign involves careful assessment of these variables. A well-chosen coin can not only serve as a financial investment but also as a piece of history to be cherished for generations. Whether you’re a seasoned investor or a new collector, recognizing these factors will help maximize the value of your gold sovereign collection.

British Gold Sovereigns: Notable Years, Rarities, and Collectible Types

British gold sovereigns hold a revered place in numismatic collections. Their long history offers rich opportunities for collectors. Certain years are particularly notable. For instance, sovereigns from the reign of Queen Victoria are highly sought after.

Some variations in design increase interest. The Young Head, Jubilee Head, and Old Head portraits are distinct iterations from Queen Victoria’s era. Additionally, Edward VII’s and George V’s reigns represent pivotal periods. Coins from these times often attract collectors due to their historical contexts.

Rarities can greatly increase value. Sovereigns from specific mint locations, such as London and Calcutta, are examples of rare issues. Collectors also cherish limited edition or proof sovereigns. These coins are specially struck and have a limited mintage, enhancing their appeal.

Some key collectible types of British gold sovereigns include:

- Victorian Sovereigns: Young, Jubilee, and Old Head designs

- Edward VII Sovereigns: Notable for their historical significance

- George V Sovereigns: Classic and widely collected

- Special Mint Marks: Coins from specific locations are more collectible

- Proof Editions: Limited, high-quality strikes

The artistry and history of British sovereigns are captivating. Designs such as St. George and the Dragon continue to intrigue collectors. Overall, British gold sovereigns offer immense diversity. They remain central to many collections across the globe.

Collectors looking for investment potential and historical interest find much to admire in British sovereigns. Their ability to capture key moments in British history makes them an enduring choice for enthusiasts and investors alike. As new collectors enter the market, the appeal and value of British gold sovereigns continue to grow.

Australian Gold Sovereigns: History, Value, and Collecting

Australian gold sovereigns hold a rich history distinct from their British counterparts. Minted between 1855 and 1931, these coins marked Australia’s economic development.

The first Australian sovereigns were minted in Sydney. They answered a growing demand during the gold rush era. This historical context enhances their value for collectors today.

Each Australian sovereign bears unique mint marks. Coins were produced in Sydney, Melbourne, and Perth. Collectors often seek these coins based on their mint origin.

The value of these coins is not just based on gold content. Factors such as rarity, condition, and historical significance play key roles.

For collectors, Australian gold sovereigns represent a piece of history. They appeal to those interested in Australia’s monetary evolution and colonial history.

Key collectible types of Australian gold sovereigns include:

- Sydney Mint Sovereigns (1855–1870): Unique designs from the early gold rush era.

- Melbourne and Perth Mint Sovereigns: Later issues with standard British designs.

- Key Date Sovereigns: Coins from years with low mintage or historical events.

These coins are not just historical artifacts. Their intricate designs capture the artistry of 19th-century minting. Collectors often face the challenge of finding well-preserved examples. Coins graded by condition will typically fetch higher prices.

In summary, Australian gold sovereigns offer a fascinating niche for collectors. They bring history, artistry, and investment potential to those who explore them. Collectors revel in hunting for specific mint marks or key dates, enhancing both personal collections and investment portfolios. As demand grows, these coins continue to hold significant cultural and financial value.

How Much Is a Gold Sovereign Worth? Current Prices and Valuation

Determining the current value of a gold sovereign involves multiple factors. The gold market price is the primary consideration, influencing sovereign coin value significantly.

Gold sovereigns have intrinsic value beyond their gold content. Historical significance and collector demand also impact their worth. Investors must evaluate these elements to understand sovereign value accurately.

The market value fluctuates with changes in global gold prices. Consequently, sovereign coin prices rise or fall accordingly. As gold is traded daily, keeping updated with market trends is crucial.

Different types of gold sovereigns fetch varying prices. Factors such as mint year, condition, and rarity affect valuation. Sovereigns from specific years, like the early 1800s, may command a premium.

Key factors influencing valuation include:

- Gold Content Value: Based on prevailing gold prices.

- Historical Value: Associated with specific mint years.

- Rarity and Demand: Coins in limited supply with high demand.

- Condition: Well-preserved coins often carry higher values.

Marketplaces such as dealers and auctions offer sovereigns for sale. Prices may also vary between these outlets, reflecting commission fees and market dynamics.

In summary, the value of a gold sovereign is multifaceted. Understanding its gold content, historical significance, and overall condition will provide a well-rounded valuation. It’s essential to stay informed about market trends and factors affecting gold sovereign worth for intelligent investment decisions. This comprehensive understanding will ensure collectors and investors alike can maximize value when buying or selling these prized coins.

How to Value Your Gold Sovereign: Grading, Condition, and Authentication

Valuing a gold sovereign accurately requires understanding coin grading and authentication. These aspects are critical in determining the coin’s worth in the market. The first step is to ensure you understand whether you have a half sovereign, or a full sovereign.

Grading evaluates the condition and quality of a gold sovereign. This process assesses aspects like wear, luster, and strike quality. Higher-grade coins generally fetch higher prices.

The condition is a significant factor in gold sovereign valuation. Coins range from “uncirculated” (excellent condition) to “circulated” (showing wear). The less wear, the more valuable the coin is likely to be.

Authentication ensures the coin is genuine, not counterfeit. With a growing number of fakes, having your sovereign authenticated by experts is crucial. Reputable coin dealers and grading services provide this verification.

Key steps in valuing your gold sovereign include:

- Conducting a Professional Grading: Determine grade based on standard criteria.

- Examining Condition: Look for signs of wear and imperfections.

- Authenticating the Coin: Verify authenticity through expert services.

- Researching Historical Significance: Understand the historical context and rarity.

Each element of the valuation process plays a role in assessing a sovereign’s market value. Accurate grading and authentication provide peace of mind and ensure fair pricing. Properly valuing your gold sovereign enhances its appeal and investment potential, making it an integral step for collectors and investors.

Where to Buy and Sell Gold Sovereigns: Dealers, Auctions, and Online Marketplaces

Navigating the gold sovereign market can be a rewarding endeavor. Deciding where to buy or sell these coins involves several reliable options.

Coin dealers are a traditional choice, offering expertise and personalized service. Reputable dealers provide authenticity guarantees and help in evaluating coin value. They often have a wide selection of sovereigns available for purchase.

Auctions present another avenue for acquiring or selling gold sovereigns. They can provide opportunities to find rare coins. Participating in an auction can lead to competitive pricing, driven by collector demand.

Online marketplaces have expanded access to buying and selling gold sovereigns. These platforms offer convenience and a broad range of listings from various sellers. However, it’s crucial to research the seller’s reputation for security purposes.

Key avenues for buying and selling include:

- Coin Dealers: Traditional, expert services with evaluation support.

- Auctions: Opportunities for rare finds and competitive bidding.

- Online Marketplaces: Convenient access with diverse listings.

By choosing the right platform, collectors and investors can maximize their transactions. Ensuring secure and informed dealings is essential when navigating these markets.

Gold Sovereigns as an Investment: Pros, Cons, and Portfolio Role

Investing in gold sovereigns appeals to both novice and experienced investors. They offer several benefits, making them a compelling addition to portfolios.

One of the main advantages is the stability they provide. Gold is historically known as a hedge against inflation and currency devaluation. Gold sovereigns maintain value during economic turbulence.

Additionally, gold sovereigns are highly liquid assets. The global demand for gold coins ensures that they can be quickly sold or traded. This liquidity makes them a flexible choice for investors who may need to convert their investments to cash.

However, investing in gold sovereigns is not without its drawbacks. They do not generate income like dividends or interest. Their value relies on appreciation and market conditions, which can fluctuate.

Overall, gold sovereigns contribute to a diversified investment portfolio. They balance risk by offsetting losses in other investment areas during market volatility.

Key investment insights include:

- Pros: Stability, liquidity, historical appeal.

- Cons: Lack of income generation, market dependence.

- Portfolio Role: Provides diversification and risk management.

Understanding these factors helps investors make informed decisions. Gold sovereigns can enhance a portfolio’s resilience and provide long-term value.

Tips for Collectors and Investors: Avoiding Fakes and Maximising Value

Gold sovereign collecting can be rewarding, but it comes with challenges. Fakes exist, and understanding how to avoid them is crucial.

Start by purchasing from reputable sources. Established dealers, well-regarded auction houses, and certified online marketplaces reduce fraud risk. Always verify the seller’s credentials before committing to buy.

Knowledge is a powerful tool for collectors and investors. Educating yourself about sovereign coins’ history, design features, and minting details can help discern authentic pieces from replicas. Familiarise yourself with common counterfeit signs such as differences in weight from the coin’s specification.

To maximize your investment’s value, proper storage is key. Keep coins in a dry environment with stable temperatures. Consider using protective cases to prevent damage and maintain condition.

Inspecting your coins regularly is beneficial. Check their appearance and condition to ensure they remain in top form. This vigilance can protect against wear that devalues the asset.

Remember these critical tips:

- Verify sellers: Stick to reputable sources.

- Educate yourself: Understand coin details.

- Maintain condition: Use proper storage techniques.

Frequently Asked Questions About Gold Sovereign Value

What is the face value of a gold sovereign?

The face value of a gold sovereign is one British pound, but its market value is much higher due to gold content.

How is a gold sovereign priced?

Market value is based on gold weight, rarity, and collector demand, not just face value.

What affects gold sovereign prices the most?

Gold market fluctuations, historical significance, and condition are key factors influencing value.

Are Australian gold sovereigns valuable?

Yes, especially rare ones from specific years or mints. Their value can be high.

How can I determine a gold sovereign’s condition?

Use numismatic grading standards to assess condition. Professional evaluation is recommended.

Where can I buy genuine gold sovereigns?

Reputable dealers, auctions, and certified online platforms are safe options for purchasing sovereigns.

Can gold sovereigns be faked?

Yes, counterfeits exist. Always verify authenticity through trusted methods or professional services.

Do gold sovereigns make good investments?

Gold sovereigns can diversify portfolios, providing stability and potential appreciation over time.

How can I protect my gold sovereign investment?

Store coins safely, consider insurance, and regularly check their condition to maintain value.

What should I know before selling a gold sovereign?

Understand current market trends and seek multiple valuations to ensure a fair sale price.

Conclusion: The Enduring Appeal and Value of Gold Sovereigns

Gold sovereigns have captivated both collectors and investors for generations. Their blend of historical significance and gold content makes them a compelling choice.

These coins offer unique value and stability amid market uncertainties. As tangible assets, they hold both monetary and numismatic worth. Whether you’re an investor seeking to diversify or a collector fascinated by history, gold sovereigns continue to shine brightly as a symbol of enduring value. Their legacy persists, reflecting a rich heritage and the timeless allure of gold.