How to Value 1 Ounce Silver Products | The Coin Chest

Silver has long been a sort after metal. Its allure spans centuries, captivating governments, investors and collectors. Today, silver remains a popular choice for those seeking tangible assets. One ounce silver products are particularly favoured for their accessibility and versatility.

These products come in various forms, including coins and bars. Each offers unique benefits and appeals to different types of buyers.

Time is precious, so before we go any further, the minimum value a 1oz silver coin is worth right now is:

$125.50 Australian Dollars (AUD) in melt value alone.

The rest of this guide will explore the underlying premium over spot price 1 troy ounce of silver attracts. Understanding the difference between troy ounce and ounces is pivotal, if you’re new to silver investing, or need a quick refresher, be sure to check out our bullion weight guide.

Understanding the value of a silver 1 ounce product is crucial for making informed investment decisions. This guide will explore the factors that influence its worth and potential. Whether you’re a seasoned investor or a curious newcomer, this article will provide valuable insights into the world of silver.

What Is a 1 Ounce Silver Product?

A 1 ounce silver product typically refers to either a coin or a bar. Both coins and bars measure one troy ounce, a standard for precious metals.

These products are cherished for their purity and weight. They serve as investment vehicles and collectibles, offering flexibility to various buyer profiles.

Many investors opt for 1 ounce silver products due to their ease of storage and liquidity. Here are common types:

- 1oz silver coins

- 1oz silver bars

- Special edition coins and bars

Each type caters to specific needs, making them popular choices for those entering the silver market.

The Importance of One Troy Ounce in Silver

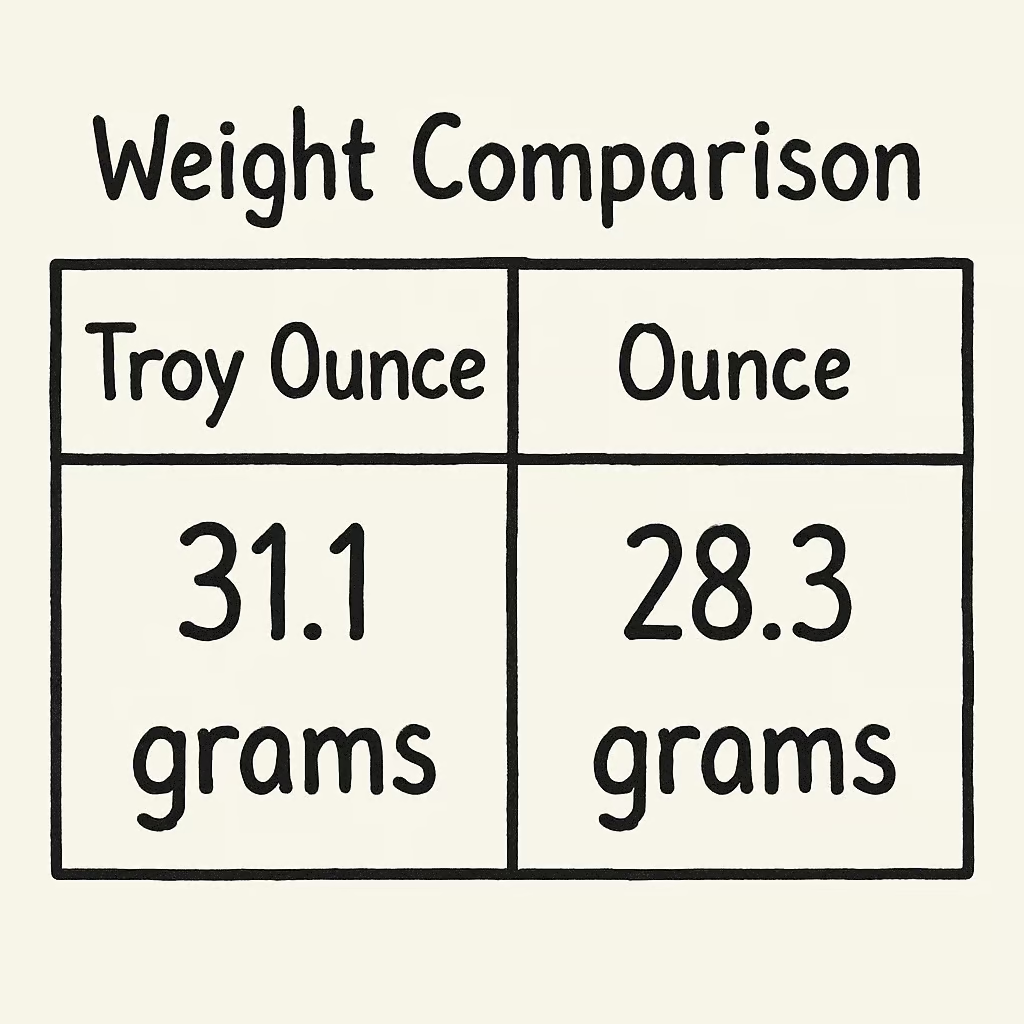

The troy ounce is the international standard for measuring precious metals. Unlike the regular ounce, a troy ounce weighs about 31.1 grams.

Understanding this unit is crucial for those buying or selling silver. It ensures accurate transactions and fair pricing in the market.

Key differences between a troy ounce and a standard ounce include:

- Troy ounce: Approximately 31.1 grams

- Standard ounce: Approximately 28.35 grams

Using troy ounces maintains consistency across global markets, making it a vital metric in the silver trade.

Types of 1 Ounce Silver: Coins vs. Bars

Silver products primarily come in two forms: coins and bars. These options cater to different preferences and investment strategies, each offering unique benefits.

Silver coins are popular among collectors and investors. They often carry numismatic value, which means their worth can exceed their silver content. Coins are typically well-crafted, featuring intricate designs and themes.

On the other hand, silver bars are often favored for their simplicity. They are usually more affordable due to lower production costs. Bars are a cost-effective choice for those focusing purely on silver content.

Here are the main differences:

- Coins: Numismatic value, intricate designs, higher premiums

- Bars: Cost-effective, simple design, focus on silver content

Investors choose based on their goals. Whether for aesthetic appeal or savings, both types offer value.

Popular 1 Ounce Silver Coins Around the World

Silver coins are cherished globally for their craftsmanship and heritage. Many nations produce their own distinct silver coins, each with its own flair and story.

For instance, the Australian Silver Kangaroo is famed for its striking design. These coins highlight Australia’s rich wildlife and have become collector’s treasures. In North America, the American Silver Eagle stands out for its reliability and quality, making it a frequent choice for investors.

Here’s a quick list of renowned silver coins:

- Australian Silver Kangaroo

- American Silver Eagle

- Canadian Silver Maple Leaf

Silver coins globally represent more than just metal. They embody cultural pride and artistic excellence, attracting both investors and art aficionados.

Understanding Silver Purity: 999 Fine and Beyond

Silver purity is crucial when evaluating silver items. The term “999 fine” indicates that the silver is 99.9% pure. This high level of purity is standard for investment-grade products.

Other purities exist, each serving different purposes. For instance:

- 999 fine: Investment-grade silver

- 958 Britannia: British coins

- 925 Sterling: Jewelry and décor

Investors typically seek high purity to ensure maximum value. While 999 fine silver is the benchmark, specific needs and uses can dictate preference for other grades.

Factors That Influence the Value of 1 Ounce Silver

Several elements affect the price of a silver 1 ounce product. Market demand often plays a significant role. High demand typically leads to increased prices.

Economic conditions also impact the value of silver. During economic uncertainty, silver’s value may rise as it serves as a safe haven. Geopolitical tensions further influence silver prices.

Additionally, factors include:

- Availability of silver resources

- Inflation rates

- Technological advances

Such fluctuations make silver investing dynamic. It’s wise to stay informed about these factors. This knowledge helps investors make sound decisions.

Silver as an Investment: Pros and Cons

Investing in a silver 1 ounce product offers various advantages. First, silver is more affordable than gold, making it accessible. Its tangible nature provides security during economic challenges.

However, silver investments come with drawbacks too. Prices can be more volatile compared to other assets. Fluctuations present risks to both new and seasoned investors.

It’s essential to weigh the pros and cons:

- Pros: Affordability, liquidity, physical asset.

- Cons: Price volatility, storage concerns, market unpredictability.

Understanding these factors is crucial. Investors can harness silver’s potential while mitigating risks. Evaluation is key before committing to a silver investment strategy.

How to Buy and Store 1 Ounce Silver

Purchasing silver 1 ounce products involves several key steps. First, choose between coins and bars based on your goals. Research different dealers to find reputable ones with competitive prices.

Once purchased, proper storage is essential. Keeping silver in a safe, dry place is vital. Consider using a home safe or a bank safe deposit box for added security.

Buying Tips:

- Compare dealer reputations and prices.

- Decide on storage location based on security needs.

- If investing in high premium silver products, regularly check the condition.

Following these tips ensures your silver remains secure and valuable. Proper storage protects your investment and gives peace of mind.

Conclusion: Is 1 Ounce Silver Right for You?

Investing in silver 1 ounce products offers unique benefits. They provide an affordable entry point into the precious metals market, making them appealing for both new and seasoned investors. With their flexibility and liquidity, one ounce silver coins and bars can fit into diverse investment strategies.

However, consider market volatility and storage needs. Your investment goals and risk tolerance should align with your choice. Whether as a hedge against inflation or a collectible, silver can play a significant role in your portfolio. Evaluate your financial objectives to determine if one oz silver is your next step. Be sure to check out our live silver and gold calculator to track your investment today.