How to Avoid Overpaying for Silver When Supply Is Low

When physical silver supply dries up, the market doesn’t just move in spot price, it moves in premiums (the amount you pay above spot). That’s where most buyers get clipped.

A lot of “normal” dealers are built for in-stock retail. That model works fine when mints are pumping out product and wholesalers can replenish on demand. But in a squeeze, that same model becomes slow, expensive, and unpredictable – and the buyer pays for it.

What goes wrong with a normal dealer during low supply

1) Higher operating costs get baked into premiums

When supply is low, dealers with bigger overheads have to protect margin harder:

- retail storefront costs (or retail-style staffing even without a storefront)

- more admin per sale (manual quoting, manual chasing, manual allocation)

- higher marketing spend to keep demand flowing

- slower inventory turnover = higher risk = higher buffer on pricing

Result: premiums blow out fast, especially on “popular” SKUs like 1oz rounds.

2) Labour-heavy processes = slower allocations and worse service

In a supply squeeze, a dealer’s workflow matters more than their intentions.

- If allocation is tracked manually, it breaks under volume.

- If inbound stock isn’t linked cleanly to customer orders, you get “we’ll let you know” responses.

- If their ops team is stretched, customer comms becomes curt or disappears.

Result: the customer experience becomes: “It’ll arrive when it arrives.”

3) Reactive pricing means you pay the shortage premium at the worst time

Most retail dealers price off what they can replace today. When replacement stock is scarce, they:

- mark up hard when stock lands (because that’s the only moment they can sell “now”)

- add safety margin because they don’t know when they can restock

- treat supply as a scarce asset instead of a planned pipeline

Result: it’s common to see buyers paying $30–$40 over spot on a basic 1oz round when the market is stressed.

The alternative: buy from a dealer built for shortages

When supply is tight, the winning model is planned sourcing + backorders + efficiency — not “hope we can restock”.

What a specialist does differently

- Runs backorders properly (not as an afterthought)

- Aggregates demand so allocations get secured earlier

- Operates leaner so overhead doesn’t inflate premiums

- Locks pricing at true market value when you order (instead of “whatever retail premium is fashionable when it lands”)

- Ships / offers pickup the moment it’s received — no mucking around

What we do at The Coin Chest (and why it matters in a squeeze)

Backorders are a feature, not a failure

We specialise in preorders/backorders because that’s how you beat the shortage premium:

- You’re not competing with the “last few units” retail scramble.

- You’re buying from an incoming pipeline, not from a scarcity shelf.

Lower premiums on silver bullion

Shortages create two prices: market value and panic retail pricing.

Our goal is to keep customers in the first bucket — typically spot + $6–$15 on common 1oz silver (depending on product and availability), not spot + $30–$40 because something finally landed.

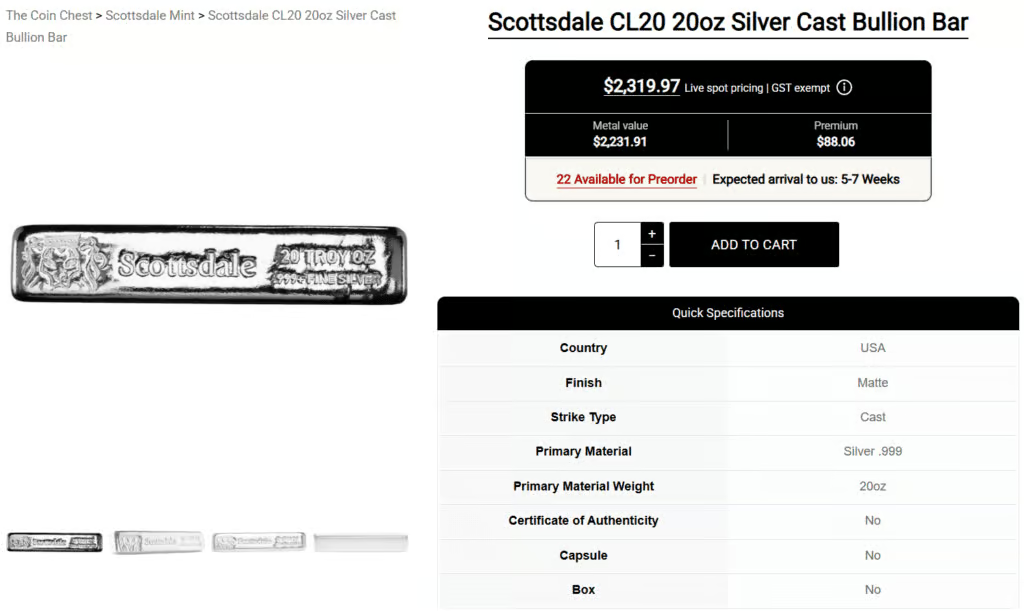

20oz Scottsdale Mint Silver Bar

Total Premium: $88.06

Premium per oz: $4.40 over spot

That’s below even normal-market premiums for many larger sized silver products.

Better lead times for the same stock

If you’re buying silver as a position, the killer isn’t just price movement — it’s paying an inflated premium on top of price movement. Locking early reduces the chance you get hit with the “it landed, therefore it’s expensive now” markup.

Direct-to-door delivery

Once your order is ready, it goes straight out via Team Global Express / AusPost (service depends on parcel type and destination). No “come back later”, no awkward stock room delays.

You can actually talk to someone

Shortages don’t excuse poor comms. If you’ve got questions about ETAs, allocations, or your order status, you get a real response — not the classic retail brush-off: “whenever it gets here.”

The simple rule during low supply

If you must have silver today, you’ll pay the shortage premium. If you can buy ahead of the crowd, you can often avoid the worst of it.

That’s the whole game: buy from pipeline, not from panic.

Buying during a shortage: 3 questions to ask any dealer

- Is my price locked at order time, or repriced when stock lands?

- Do you run proper backorders with allocated inbound stock, or is it “best effort”?

- What’s your average lead time based on supplier allocation?